Paul is recognised industry

leader and a frequent speaker and industry commentator who in 2017

co-chaired a Bank of England industry group to develop the UK Money

Markets code. Equity securities what do you mean by secondary market generally refer to stocks, which are shares that you purchase in a company. When you buy an equity security, you own a piece of the company and have a stake in how the business performs.

Debt securities can be secured (backed by collateral) or unsecured, and, if secured, may be contractually prioritized over other unsecured, subordinated debt in the case of a bankruptcy. Equity securities do entitle the holder to some control of the company on a pro rata basis, via voting rights. In the case of bankruptcy, they share only in residual interest after all obligations have been paid out to creditors. The Securities Act of 1933 is the first federal legislation to regulate the U.S. stock market, an authority that was previously regulated at the state level.

Other forms of securities

Such a bond may be used as a financing device to obtain funds at a low interest rate during the initial stages of a project, when income is likely to be low, and encourage conversion of the debt to stock as earnings rise. An initial public offering is when a company issues public stock newly to investors, called an “IPO” for short. A company can later issue more new shares, or issue shares that have been previously registered in a shelf registration. These later new issues are also sold in the primary market, but they are not considered to be an IPO but are often called a “secondary offering”. Issuers usually retain investment banks to assist them in administering the IPO, obtaining SEC (or other regulatory body) approval of the offering filing, and selling the new issue.

Melissa Gow oversees client facing activities for the global

securities finance business, including the product specialist and

client services teams, consultancy, marketing, and commentary. She

has extensive experience in securities finance and is a frequent

speaker at industry events.Previous industry experience includes roles at Goldman Sachs and

Swiss Bank Corporation. S&P Global Securities Finance data support research that provides insights on the securities lending market, risk factors and potential alpha generating strategies. In addition to our own publications, S&P Global data is used by academics and third parties. No, securities don’t have anything to do with protecting your passwords or installing a hidden camera in your home.

- Products and services referenced are offered and sold only by appropriately appointed and licensed entities and financial advisors and professionals.

- Regulatory responsibilities are frequently taken on by self-regulatory organizations (SROs) in the brokerage industry.

- She

has extensive experience in securities finance and is a frequent

speaker at industry events.Previous industry experience includes roles at Goldman Sachs and

Swiss Bank Corporation. - Held by an inactive investment crowd, they are more likely to be a bond than a stock.

- There are various asset allocation methods that involve diversification.

- These later new issues are also sold in the primary market, but they are not considered to be an IPO but are often called a “secondary offering”.

Consumers should revisit these filings regularly to keep up to date with the status and condition of a financial adviser. Perhaps you’d prefer the attention and dedication of a smaller adviser or the resources and scale of a larger adviser. Streamline securities finance and collateral management with an integrated solution for firms of all sizes on both the buy-side and sell-side. Optimize inventory, enhance trading opportunities, reduce costs and improve efficiency across your business through full front- to back-office functionality. Pension and mutual funds have different goals, but they generally fall into a few basic categories like capital gains, passive income, and capital preservation.

Sometimes companies sell stock in a combination of a public and private placement. When businesses issue securities in the form of stocks and bonds, investors buy them. These securities can then be traded on the secondary market once they have been issued. A business can either find private investors or go to the capital markets and issue securities in the form of publicly traded stock when it takes on more owners in order to grow. As the company makes a profit, you will share in that profit in one of two ways.

What Are Treasury Securities?

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company and its subsidiaries. Life and disability insurance, annuities, and life insurance with longterm care benefits are issued by The Northwestern Mutual Life Insurance Company, Milwaukee, WI (NM). Longterm care insurance is issued by Northwestern Long Term Care Insurance Company, Milwaukee, WI, (NLTC) a subsidiary of NM. Investment brokerage services are offered through Northwestern Mutual Investment Services, LLC (NMIS) a subsidiary of NM, brokerdealer, registered investment advisor, and member FINRA and SIPC. Investment advisory and trust services are offered through Northwestern Mutual Wealth Management Company (NMWMC), Milwaukee, WI, a subsidiary of NM and a federal savings bank. Products and services referenced are offered and sold only by appropriately appointed and licensed entities and financial advisors and professionals.

Securities lending is the practice of loaning shares of stock, commodities, derivative contracts, or other securities to other investors or firms. Securities lending requires the borrower to put up collateral, whether cash, other securities, or a letter of credit. You have the right to trade other securities at pre-agreed upon terms with derivative securities, rather than owning something outright, like shares of a stock. They give you the right to buy or sell shares at a certain price by a certain date. Similar to bonds, they typically promise to pay a higher interest at a fixed or floating rate until a certain time in the future. Unlike a bond, the number and timing of interest payments are not guaranteed.

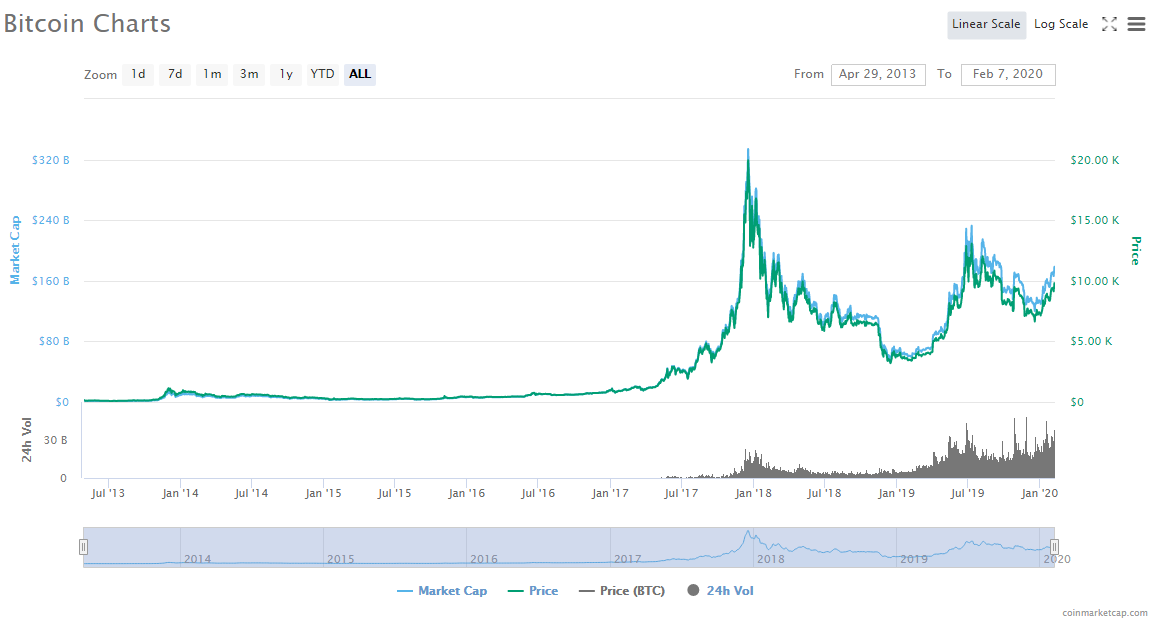

They can even be converted into shares, or an investment can be terminated at any time. Debt securities, such as bonds and certificates of deposit, as a rule, require the holder to make the regular interest payments, as well as repayment of the principal amount alongside https://1investing.in/ any other stipulated contractual rights. Such securities are usually issued for a fixed term, and, in the end, the issuer redeems them. Many people think of cryptocurrencies as being similar to stocks, and, in some cases, some crypto assets do behave like stocks.

In December 2014, we published a position paper on long term financing, securitisation and securities financing, “A missed opportunity to revive “boring” finance? This sets out our views and recommendations on the systemic implications of increased collateral usage, an inevitable consequence of CMU proposals to revive securitisation and promote cross-border collateral usage. The paper provided the basis for a discussion panel on collateral use in our February 2015 conference “The long term financing agenda – the way to sustainable growth? ” We also organised a webinar on securitisation (27 July 2015), available online.

Build your skills with a risk-free demo account.

A business must go to the capital markets and issue a debt security called a “bond” when the bank option is exhausted. Investment securities provide banks with the advantage of liquidity, in addition to the profits from realized capital gains when these are sold. If they are investment-grade, these investment securities are often able to help banks meet their pledge requirements for government deposits. In this instance, investment securities can be viewed as collateral. For example, the number of Type II securities or securities issued by a state government is restricted to 10% of the bank’s overall capital and surplus. It is important to mention that the dollar value of the daily trading volume of debt securities is significantly larger than stocks.

Finance Committee Mondelēz International, Inc. – Mondelez International

Finance Committee Mondelēz International, Inc..

Posted: Wed, 13 Sep 2023 14:30:22 GMT [source]

However, equity generally entitles the holder to a pro rata portion of control of the company, meaning that a holder of a majority of the equity is usually entitled to control the issuer. Equity also enjoys the right to profits and capital gain, whereas holders of debt securities receive only interest and repayment of principal regardless of how well the issuer performs financially. Furthermore, debt securities do not have voting rights outside of bankruptcy. In other words, equity holders are entitled to the “upside” of the business and to control the business. Securities may be represented by a certificate or, more typically, they may be “non-certificated”, that is in electronic (dematerialized) or “book entry only” form.

Securities Lending

Equity warrants are options issued by the company that allow the holder of the warrant to purchase a specific number of shares at a specified price within a specified time. They are often issued together with bonds or existing equities, and are, sometimes, detachable from them and separately tradeable. When the holder of the warrant exercises it, he pays the money directly to the company, and the company issues new shares to the holder. Preference shares form an intermediate class of security between equities and debt. If the issuer is liquidated, preference shareholders have the right to receive interest or a return of capital prior to ordinary shareholders.

A convertible bond, for example, is a residual security because it allows the bondholder to convert the security into common shares. Corporations may offer residual securities to attract investment capital when competition for funds is intense. Our data is sourced directly from leading industry practitioners, including prime brokers, custodians, asset managers and hedge funds.

Investment

If an asset isn’t a security, it generally isn’t regulated by the U.S. Crypto investors currently have very little protection provided by the SEC because the world of crypto remains largely unregulated. The bond, as a debt instrument, represents the promise of a corporation to pay a fixed sum at a specified maturity date, and interest at regular intervals until then. Bonds may be registered in the names of designated parties, as payees, though more often, in order to facilitate handling, they are made payable to the “bearer.” The bondholder usually receives his interest by redeeming attached coupons. Regulatory and fiscal authorities sometimes regard bearer securities negatively, as they may be used to facilitate the evasion of regulatory restrictions and tax. In the United Kingdom, for example, the issue of bearer securities was heavily restricted firstly by the Exchange Control Act 1947 until 1953.

Securities may also be held in the direct registration system, which records shares of stock in book-entry form. In other words, a transfer agent maintains the shares on the company’s behalf without the need for physical certificates. They are typically issued for a fixed term, at the end of which they can be redeemed by the issuer.

A security, in a financial context, is a certificate or other financial instrument that has monetary value and can be traded. Bonds, bank notes (or promissory notes), and Treasury notes are all examples of debt securities. They all are agreements made between two parties for an amount to be borrowed and paid back – with interest – at a previously-established time. Hybrid securities combine some of the characteristics of both debt and equity securities. Supranational bonds represent the debt of international organizations such as the World Bank[citation needed], the International Monetary Fund[citation needed], regional multilateral development banks[vague] and others.

Through securities, capital is provided by investors who purchase the securities upon their initial issuance. In a similar way, a government may issue securities when it chooses to increase government debt. Derivatives are something of a special case, as they can be traded on derivatives exchanges. For instance, futures contracts are often traded on futures exchanges, while CFDs have a range of specialist CFD platforms where people can often use leverage, or borrow money in order to trade with it, to access the market.

Securities in finance are instruments that serve as a source of funding for the backer and risk for the buyer of an asset. It’s essentially something of substantial value that may be traded between parties. Certificated securities are those represented in physical, paper form.

Therefore, Linus Financial was required to register its offers and sales of the Linus Interest Accounts. We provide enhanced visibility and insight into the market for collateral cash investments, demand, pricing and usage, and we deliver Repo data and analytics. Collateral and funding managers of prime dealers, banks, money market funds, securities lenders, hedge funds, insurance companies and corporations benefit from this comprehensive combination of repo and securities lending data and analytics.

Current shareholders sell their securities to other investors, ideally for a profit, which means they sell their assets for a higher price than they paid for them. When you purchase a security, you are effectively crediting your funds to the association. The association compensates you for the bond by paying you irregular payments with interest. Bonds, as well as some stocks and shares, can be traded on the over-the-counter (OTC) markets, meaning that they can be bought and sold directly, rather than having to go through a broker.

Stock performance moves up and down based on many factors, including how the economy is doing, how the business itself is doing, what’s happening in the world and other events you can’t really predict or control. There is risk involved with investing in stocks because they can be volatile. Hybrid security, as the name suggests, is a type of security that combines characteristics of both debt and equity securities. Many banks and organizations turn to hybrid securities to borrow money from investors. Hybrid securities combine features of both equity and debt securities.